What is Outsourced Accounting and How Could It Help You?

That’s why many businesses — from fledgeling startups to multinational enterprises — opt to outsource instead. There are 3 types of organizations that handle these types of services. When you use an external party, the process doesn’t include hiring, supervising, and onboarding expenses. In 2024 and beyond, accountants are going to meet a lot of new challenges. Benefits of outsourcing include keeping your own headcount low, as well as a greater range of skillsets and tech knowledge than you would otherwise be able to access.

Step 1 – Prepare the Business for Outsourcing

This will make sure you fulfil your legal requirements regarding taxes and will also ensure you have a good grasp on the overall financial health of your business at any given time. Accounting firms have likely worked with many businesses like yours and have seen it all, including the successes as well as the mistakes that other companies have made. This experience makes them well-equipped to apply their knowledge to your business.

Outsourced fiscal year-end financial filing

- It comes with fewer add-on features or upgrades, but for those who just need assistance keeping the numbers accurate, Pilot is an excellent fit.

- That’s why our outsourced accounting services are set up to provide firms with the exact level of support they need.

- Outsourcing bookkeeping services means you have to pay less than these numbers.

- We wouldn’t blame you if you shudder at the thought of tracking all your transactions, but if you outsource bookkeeping responsibilities, you’ll never have to worry about it.

- If you’d like to outsource some or all of your accounting obligations, here’s how to get started.

If you’re ready to take the plunge with BINERY’s bookkeeping services, we’d love to welcome you. Most services will have an onboarding process you have to go through when you get started. This is also where you will connect your accounting software or get one set up if you don’t have one. You’ll find that the cost of outsourced bookkeeping options are much friendlier to your wallet. Services start at under $100 per month and can reach up to about $1,000 per month.

The Ultimate Guide To Outsourced Bookkeeping 2023

Maintaining regular communication with your provider is key to building a strong, collaborative relationship and addressing potential misunderstandings before they escalate. Set up check-ins with your provider every once in a while to discuss the partnership and convey expectations. You should also specify what happens if the provider fails to meet any of these expectations.

Organizing all of your business’s financial data into a centralized, accurate record is a monotonous task. Although technology has streamlined the process somewhat, bookkeeping remains a challenge for many business owners. In doing that, your outsourced accounting firm will work closely with you to develop an approach that works for your business. They’ll track KPIs that are important to you, provide regular financial reporting, and be responsive to your needs when you call with questions. Your company can gain game-changing financial insights and unlock benefits including increased cash flow and higher profit margins.

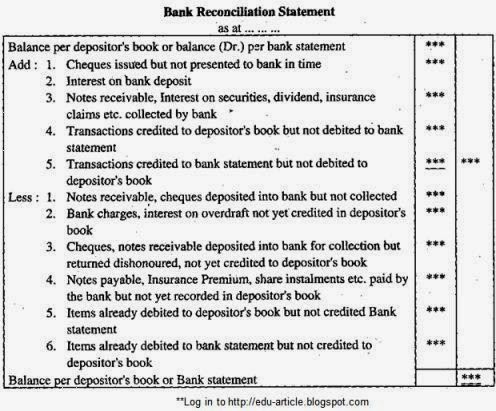

Outsourced bookkeeping works by delegating your business’s financial management tasks to external professionals or firms specializing in bookkeeping and accounting services. Essentially, you’ll give a third-party bookkeeper access to important financial information like bank statements, payroll, tax documents, and your accounting software. They’ll take it from there, generating financial reports, ensuring your ledgers are up to date, and tracking money that goes both in and out of the company, among other essential tasks. Having all your documents in order will ensure a smooth transition and effective management of your outsourced bookkeeping services.

At some point, you may find it more beneficial to move some or all of your accounting processes in-house. But the majority of companies just want to meet their obligations with minimal fuss, and entrust the heavy https://www.business-accounting.net/ lifting to trained experts. If you’re communicating clearly with a trustworthy partner, this doesn’t need to be a negative. As alluded to in the previous step, outsourcing isn’t a “set it and forget it” solution.

But Merritt Bookkeeping’s most stand-out feature might be its in-depth financial reports. Most other virtual bookkeeping services give you basic financial reports only, like income statements and balance sheets. In contrast, Merritt gives you more detailed reports like forecasting and quarterly comparisons. It also starts at $190 a month, which is less than nearly every other provider on our list.

Compare your options and choose a provider that meets your requirements and, of course, your budget. To learn more about how Remote can make your payroll operations quick and accounting definition simple, check out our in-depth payroll processing guide. As a result, it’s helpful to understand what you might want to outsource, and what you might want to keep in-house.

However, in this case, you would still be responsible for doing your own books. If your business is new and you don’t have significant revenue or budget to hire outside help, you’ll probably try DIY bookkeeping first. If you don’t already work with accounting software we’ll get you set up with one. Then we’ll make sure the proper communication channels are in place so that we can get in touch when we need to. No matter which state you operate your business from, you’ll have to provide some sort of year-end report.

He also ensures your books are always up-to-date so that if you need to pull out any data, you can do so with confidence without having to worry about accurate data. The bookkeeper does this on a regular basis to ensure https://www.business-accounting.net/what-does-vertical-analysis-of-a-balance-sheet/ every transaction that has been recorded is precise. Intended to automate the majority of both your bookkeeping efforts as well as your tax preparation, 1-800Accountant turns a major hassle into a huge relief.

You can manage all your payroll and HR benefits from the Gusto platform, and if you ever have questions, you can ask one of their payroll specialists. If you do decide to pay a third party to handle your accounting, be aware of the potential for scope creep. You’ll want to set clear expectations from the start about the scope of work, not to mention how to handle any tasks outside of that scope, especially if you’re paying hourly.

Recent Posts

Игровые Автоматы 777 Играть Онлайн Бесплатно И На Деньги В Казино

The Development and Impact of Online Gaming in Australia

All Categories

- ! Sem uma coluna

- ! Senza una colonna

- ! Without a column

- ! Без рубрики

- 1

- 1w

- 1Win AZ Casino

- 1Win Brasil

- 1win Brazil

- 1WIN Casino Brasil

- 1win India

- 1WIN Official In Russia

- 1win Turkiye

- 1win uzbekistan

- 1winRussia

- 1xbet Korea

- 1xbet Morocco

- 1xbet russia

- 1xbet russian

- 2

- 7 slots

- 7slots

- 7slotscasino

- acad

- AI Chatbot News

- AI News

- Article

- Artificial intelligence

- asian brides

- Bahis siteleri

- Bahis sitesi

- Bahis-Siteleri-Mobil-Ödeme-İmkanları-2024.html

- Base

- best dating sites review

- bet-casino-siteleri_3

- bet10

- bet10 casino

- bet10-casino

- bffsf

- bh_aug

- Big-Bass-Bonanza-Yeni-Slot-Oyunu-İncelemesi.html

- Bigger-Bass-Bonanza-Yorumları-Slot-Oyunu-İncelemesi(3).html

- blog

- Bookkeeping

- Bootcamp de programação

- Bootcamp de programación

- Bussiness

- casino

- casino-okey_1

- Casino-Oyunları-Algoritması-Açıklaması(3).html

- Casino777SilverBitcoin

- casinom-hub_aug

- casinomaxi

- chinese dating

- Clean content

- Clover-Link-Nedir-Online-Kumar-Oyunları-Hakkında(1).html

- Configuration

- content2

- Cryptocurrency exchange

- Cryptocurrency News

- dirty-talk

- Dog-House-Slot-Oyna-Eğlenceli-Kumar-Deneyimi.html

- Education

- Ethereum-Kabul-Eden-En-İyi-Casino-Siteleri-2024(7).html

- Events

- find a bride

- find a woman online

- FinTech

- Forex Trading

- Games

- gates-of-olympus-indir

- Gerçek-Para-Çevrimiçi-Kumar-Siteleri-Rehberi(4).html

- GGBet

- girls-do-porn

- hitbet

- hovarda

- IT Education

- IT Вакансії

- IT Образование

- IT Освіта

- japanese mail order bride

- kmsautodddddddd

- latin brides

- latin dating

- latin dating online

- leramiss

- Life Style

- Logs

- mail order bride

- mail order brides

- mail order wife

- Mostbet AZ Casino

- mostbet tr

- Mostbet UZ Kirish

- Music

- My Blog

- Myofascial

- Networking

- News

- online dating

- Optimization

- padisahbet

- perabet

- pin up casino

- Pin UP Casino AZ

- Pin Up Peru

- plinko

- processed

- prostoforex.com

- PU_aug

- Reflexology

- rulet-oyunları

- russian brides

- sexting

- sexy-girls

- slot-pragmatic-gates-of-olympus

- slottica

- Sober living

- Software development

- Starlight-Princess-1000-Logo-Slot-Oyunu-İncelemesi(2).html

- Storage

- Sugar-Rush-Slot-Deneme-Bonusu-İle-Kazanın(6).html

- sweet-bonanza-deneme-oyunu_1_1

- Sweet-Bonanza-Nasıl-Para-Kazanılır-İpuçları-ve-Stratejiler.html

- sweet-bonanza-ne-anlama-gelir_21

- Sweet-Bonanza-Oyunu—Para-Kazandıran-Şeker-Oyunu(7).html

- Technology

- thai women dating

- The-Dog-House-Slot-RTP-Kazanma-Şansınız(6).html

- Tournaments

- tr

- Uncategorized

- Uptime

- Wild-West-Gold-Nasıl-Oynanır-Detaylı-Slot-Rehberi.html

- women for marriage

- xslot

- xslotscasino

- Yeni-Üyelere-Deneme-Bonusu-Veren-Bahis-Siteleri.html

- водка

- Новости

- Новости Криптовалют

- Финтех

- Форекс Брокеры

- Форекс Обучение

- Форекс партнерская программа